Veterans in Texas might qualify for one of the strongest, yet underutilized, financial benefits: property tax exemption for disabled veterans. Backed by the state, such an exemption can seriously lower or even completely eliminate property taxes on a veteran’s primary residence, depending on one’s VA disability rating. This exemption is designed to honor military service and ease some long-term housing costs. The Texas disabled veteran property tax exemption can save thousands for qualified veterans and their families each year. Knowing how it works is but the first step to securing these well-deserved savings.

Key Takeaways

- 100% disabled veterans pay $0 in property taxes on their primary residence in Texas, with the exemption continuing for eligible surviving spouses.

- Veterans with 10%–99% VA disability ratings still qualify for meaningful savings, receiving partial exemptions ranging from $5,000 to $12,000 on one property.

- Exemptions can be stacked with the general homestead exemption and age-65 benefits, significantly increasing long-term tax savings.

- Applying is straightforward but deadline-driven—accurate documentation and filing by April 30 are critical to avoid delays or lost benefits.

- Decisions can be verified and appealed, and working with a VA-friendly realtor or county appraisal district helps veterans maximize and protect their tax relief.

What Is the Disabled Veteran Property Tax Exemption?

Tax exemption varies from state to state, depending on a range of factors. Texas is one of the 18 US states that provides a 100% exemption from property taxes for veterans. That is one of the main reasons why Texas is a Financial Haven for 100% Disabled Veterans

The Texas disabled veteran property tax exemption is a state initiative that helps veterans with service-related disabilities. It further lowers or removes their property tax obligations.

This tax exemption demonstrates the state’s commitment to recognizing military service and assisting those who have sacrificed for their nation.

Texas veterans must provide evidence of –

- Individual Unemployability VA status

- 100% Permanent and Total VA disability designation

The surviving spouses also qualify for the same tax exemptions, provided they stay unmarried and occupy the exempt property.

The Texas Disabled Veteran Property Tax Exemption provides vital financial support to numerous veterans and their families.

It lowers yearly housing expenses and ensures that those who have served and their families experience the safety and security of owning a home.

Also Check: Difference Between Texas Vet Loan and VA Loan

Legal Basis for the Exemption

These benefits are enshrined in the Texas Tax Code:

- §11.131: Provides a 100% exemption on the residence homestead for veterans rated 100% disabled or unemployable by the VA.

- §11.22: Offers partial exemptions (based on rating) for any one property owned by the veteran.

Surviving spouses and children may continue benefits under specific rules. Always verify with your local county appraisal district (CAD), as implementation can vary slightly by location.

Texas Disabled Veteran Benefits

- Reduces Your Home’s Taxable Value: The exemption eliminates part of your home’s assessed value from tax calculations. It leads to taxation on a significantly reduced amount. Your VA disability rating determines the amount, which can range from several thousand dollars to the full value of your home.

- 100% Disabled, Pay $0 in Property Taxes: If the VA rates you as 100% disabled, Texas law enables you to remove your full property tax obligation on your primary home. It will make your residence fully tax-exempt, saving you thousands of dollars annually.

- Partial Exemptions Add Up: Even if you have less than a 100% rating, partial exemptions determined by your disability percentage also lead to substantial savings. For example, a 50% deduction reduces your yearly tax obligation by half.

- Long-Term Savings: Property taxes are a recurring cost, so these savings accumulate annually. With time, veterans can accumulate savings of tens of thousands of dollars, offering greater financial security and independence.

- Help Surviving Spouses: If the veteran passes away, the surviving spouse will be able to retain the benefits of the exemption, providing continued savings for your family.

Texas Disabled Veteran Benefits: How It Reduces Your Taxes

This exemption cuts your home’s taxable value, directly lowering your bill. Texas’s average property tax rate is about 1.8–2.2%, so even partial relief adds up.

- Full Exemption for 100% Rating: No taxes on your primary home—potentially saving $3,000–$10,000+ yearly on a $300,000 property.

- Partial Exemptions: Fixed dollar reductions based on your rating, applicable to one property (homestead or not).

- Stackable with Others: Combine with the general homestead exemption ($100,000 reduction for school taxes) or age 65+ benefits for bigger savings.

- Surviving Spouse Protection: Keeps the exemption going, providing family stability.

Over 10 years, a 50% rated vet might save $15,000–$20,000 cumulatively.

Understanding Eligibility Requirements for Veterans’ Property Tax

It is crucial to understand Texas veteran exemptions and who qualifies for them. Eligibility depends on factors such as your VA disability rating, disability type, where you live, and your family situation. Knowing these requirements will help you get the maximum benefit.

The eligibility requirements are –

VA Disability Rating Thresholds (0–100% and Special Cases)

Eligibility for the Property Tax Exemption for Disabled Veterans in Texas is mainly based on your VA disability rating. Ratings are given in increments of 10%, ranging from 0% to 100%.

The higher your rating, the bigger your exemption. Individuals with a 100% rating qualify for a complete exemption, eliminating their property tax obligation on their primary residence.

Types of Qualifying Disabilities

Your disability must be linked to your service to be eligible. Qualifying disabilities are diverse and may encompass physical impairments (such as loss of a limb or mobility difficulties), PTSD, traumatic brain injuries, vision impairment, or hearing issues.

Veterans eligible for VA grants for specially adapted housing may qualify for additional property tax relief. Their requirement for adaptation is acknowledged as service-related.

Residency and Property Ownership Rules

The exemption applies to your primary residence in Texas. You must possess and reside in the property as your primary home. Properties for investment, rental, or holiday use do not meet the criteria.

When submitting your application, you must include documentation like a Texas driver’s license, proof of residency, and your property deed to verify that you fulfill these criteria.

Special Provisions for Surviving Spouses

Texas also offers this assistance to families. When a disabled veteran dies, the surviving spouse can maintain the exemption provided they do not remarry and remain in the same residence.

In certain situations, dependent children may also gain advantages. It is particularly if the veteran passed away while on duty or due to a service-related cause.

VA disability tax benefits in Texas ensure that families continue to receive financial assistance during challenging periods.

Age 65+ Overlap with Homestead Exemptions

Veterans who are 65 years old or older may also be eligible for the Texas homestead exemption for veterans, as well as the Disabled Veteran Exemption.

These exemptions can be combined, resulting in even greater tax savings. For older veterans on fixed incomes, this combination of benefits can significantly enhance the affordability and security of homeownership.

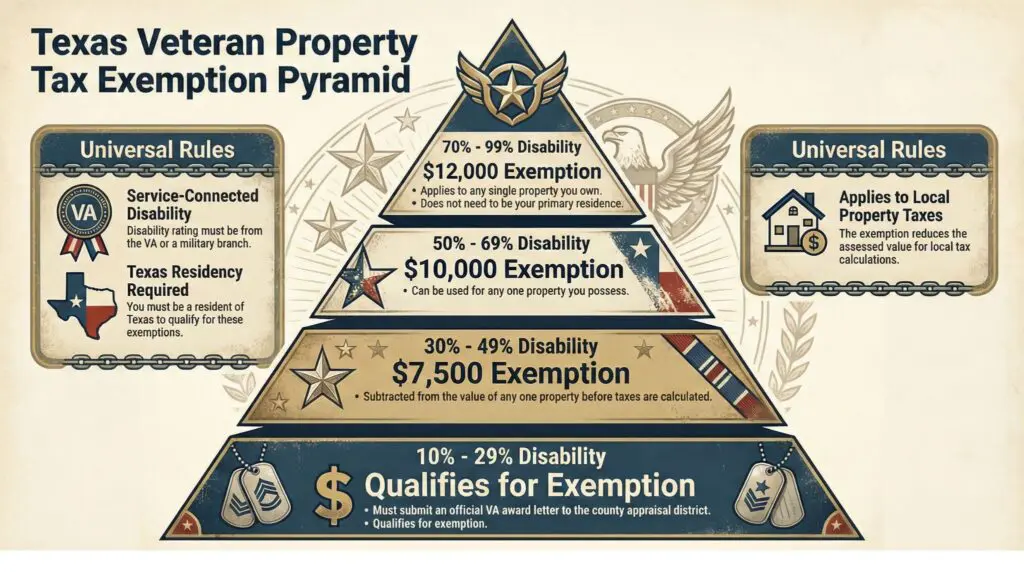

Levels of Exemption and How Texas Disabled Veteran Benefits?

How much you can save with the Texas Disabled Veteran Property Tax Exemption depends on your VA disability rating.

Understanding the various exemption levels will help in calculating your possible tax relief. It will help you demonstrate how significantly this advantage will increase your annual savings.

The different levels of exemption are –

100% Disability Rating

A 100% VA disability rating signifies that the veteran is officially recognized as completely disabled. It can be derived from a single disability or several disabling conditions assessed under a combined rating.

Veterans rated with a 100% disability qualify for the maximum compensation, which is the complete removal of property taxes.

Exemption for Partially Disabled Veterans

Disabled veterans who do not meet the requirements for 100% disability or Individual Unemployability can benefit from certain property tax exemptions in Texas.

Thus, veterans with a disability rating of 99% or higher can reduce their property taxes.

It includes –

70% to 99% Disability Rating

The evaluated value of the property for the veterans with 70% to 99% disability is reduced by the $12,000 exemption. It applies to any single property owned by the veteran as of January 1 of the tax year, regardless of whether it is their primary residence, unlike the 100% exemption.

50% to 69% Disability Rating

You must be a Texas resident with a service-connected disability rating of 50% to 69%. This rating must be applicable according to the US Department of Veterans Affairs (VA) or your military branch.

A veteran with this service-related disability rating will receive a $10,000 exemption from the assessed value of one property.

It is valid for all local property taxes and can be utilized for any property you possess. It is not limited to your primary residence, but you can use it for only one property.

30% to 49% Disability Rating

In Texas, a veteran with a service-related disability rating ranging from 30% to 49% qualifies for a $7,500 exemption. It is assessed based on the value of any property they own. The amount is subtracted from the property’s value before tax calculations, thus reducing the tax liability.

10% to 29% Disability Rating

You must be a resident of Texas with a service-related disability rating of not less than 10% from the VA or military services. An official VA award letter must be submitted to the county appraisal district.

In Texas, a veteran with a service-connected disability rating of 10% to 29% will receive a $5,000 exemption on one property. It is an exemption from property tax since Texas lacks a state income tax.

Homestead vs. Disabled Veteran Exemption: Quick Comparison

Texas exemptions can overlap—clarifying them prevents confusion.

| Aspect | Residence Homestead Exemption | Disabled Veteran Exemption (§11.22 Partial) | 100% Disabled Homestead (§11.131) |

|---|---|---|---|

| Who Qualifies | Any Texas homeowner (primary residence) | 10–99% disabled vets/survivors | 100% disabled vets/survivors |

| Amount | Up to $100,000 (school taxes); more for 65+/disabled | $5K–$12K based on rating | Total value |

| Applies To | Primary residence only | Any one property | Primary residence only |

| Form | 50-114 | 50-135 | 50-114 (with VA proof) |

| Stackable? | Yes, with DV exemptions | Yes | Yes, with general homestead |

Step-by-Step Application Process – Texas Property Tax Exemptions for Veterans

Applying for the Texas Property Tax Exemption for Disabled Veterans is simple. Adhering to a structured, step-by-step method ensures that your application is precise and thorough. It increases your chances of approval and lets you receive your tax savings promptly.

The step-by-step process includes –

Understand Eligibility Requirements

Before looking for any property tax exemption, ensure that you satisfy the particular eligibility requirements. Texas provides a variety of exemptions, such as for homesteads, seniors, veterans, and charitable organizations.

Specific requirements accompany each of them. For example, the homestead exemption typically requires that the property be your primary residence as of January 1 of the tax year.

Gather Necessary Documentation

Precise and detailed documentation is essential for a successful application. Generally, you will require evidence of ownership, identification, and any pertinent documents showing your eligibility. It includes age verification for senior discounts or service records for veterans.

Submit Your Application on Time

Submission within the given time is essential during the application process. The majority of Texas counties require exemption applications to be filed by April 30 of the tax year. Failing to meet this deadline could result in missing out on potential savings until next year.

Consult With Professionals If Needed

If you have questions about the application process or need help, consider seeking advice from experts. The expert realtors help property owners navigate the intricacies of obtaining exemptions and effectively maximize potential tax savings.

You must also consider the following while applying for property tax reduction for Texas veterans –

- If your disability rating is between 10% and 99% as per the VA, you can seek two kinds of exemptions: the Residence Homestead Exemption and the Disabled Veteran Partial Exemption.

- You need Forms 50-114 and 50-135 (the Application for Disabled Veterans or Survivors Exemption) to apply for both exemptions. You also need to provide the VA proof of disability letter and an ID copy that links to the address of the property for which you seek exemption.

- Generally, applications are filed from January 1 to April 30 to obtain an exemption for the current tax year. If not, they will be carried over to the next tax year.

Common Mistakes and How to Avoid Them

Applying for property tax exemptions in Texas can lead to significant savings for property owners, but the process can be challenging. Minor errors can delay your benefits or even reduce your exemption amount.

By recognizing the common mistakes and understanding how to avoid them, you simplify the application process. It ensures you receive all the funds you are qualified for.

Here are some common mistakes to avoid:

- Missing Deadlines: In Texas, the deadline to apply for most property tax exemptions is April 30. Not submitting applications by the given deadline results in missing out on crucial tax savings for that year.

- Incomplete Applications: Submitting wrong or partial information on your exemption application results in delays or rejection. Ensure all mandatory fields are completed correctly and that any essential documentation is attached.

- Not Updating Exemption Status: Any changes in property ownership or use should lead to a review of your exemption status. If you fail to update your status, you may lose eligibility for certain exemptions.

- Assuming Automatic Renewal: Some property owners think their exemptions renew automatically each year. But certain exemptions require reapplication or evidence of ongoing eligibility.

- Overlooking Available Exemptions: Texas provides numerous exemptions. These include exemptions for homestead, agricultural use, veterans, and seniors. Failing to explore all available choices may result in overlooking possible savings.

See Also: Can I Have Two VA Mortgages At The Same Time?

How to Verify and Appeal Property Tax Decisions?

After submitting your application for the Texas Disabled Veteran Property Tax Exemption, it is crucial to verify the result. You must understand your rights if you oppose the decision.

Knowing how to confirm your exemption status and manage the appeals process can help ensure you obtain the complete benefits you deserve.

Here, we will explore how to verify and appeal the VA disability property tax decisions –

Review the Notice of Appraised Value

The notice will usually be sent by your local appraisal district around April or May. Examine it thoroughly and ensure all information about your property is accurate.

File a Protest

You must submit a Notice of Protest (Form 50-132) to your county’s appraisal review board (ARB) to challenge the decision. Generally, the deadline is either May 15 or 30 days after the appraisal district’s notice, whichever occurs later.

You can file your protest:

- Online

- By mail

- In person

Gather Your Proof

Effective appeals depend on substantial evidence. You must be prepared with –

- Current sales information for similar properties

- Independent appraisals

- Images depicting harm or elements that diminish your property’s worth

- Records of incorrect property records

Attend the ARB Hearing

Once you submit your protest, the ARB (Appraisal Review Board) will arrange a hearing. During this meeting, you may share the case and supporting evidence.

The appraisal district will additionally share its perspective. You must concentrate on the facts and explain your reasons regarding the adjustment in your property’s value.

How can a VA-friendly Realtor help you?

A VA realtor is a vital resource for veterans seeking veteran property tax relief in Texas. Their expertise and familiarity with VA benefits, loans tailored for veterans, and associated property tax exemptions help you save time. They also help prevent expensive errors and optimize your benefits.

Here’s how a VA-friendly realtor helps you in this process –

- Expert Guidance on Qualifications and Exceptions: Military friendly real estate agents understand the unique requirements of military families. They are well aware of the disabled veteran property tax exemption. They help you in figuring out if you meet the qualifications, clarify the details of VA disability ratings, and highlight the necessary documentation for your application.

- Finding the Right Property: These experienced real estate agents know which properties qualify for homestead exemptions. They also help you in locating a home that suits your requirements. If you are looking for accessibility options, specific areas, or properties that will enhance your tax benefits, reach out to the realtors.

- Navigating the Application Process: A realtor experienced with VA benefits will guide you through the exemption application process. They ensure all documents are completed correctly and help you avoid common errors that delay the process.

- Connecting You with Other Resources: They frequently maintain relationships with lenders, VA offices, county tax assessors, and other experts who assist veterans. This network enhances your experience and helps you resolve any problems swiftly.

Ensuring Property Tax Relief and Unlock Savings with Veterans Property Tax

If you own property, understanding the applicable exemptions can significantly reduce your property tax burden.

The Disabled Veteran Property Tax Exemption is a powerful way for the state to honor military service and help veterans and their families. Implementing this exemption will make a massive difference in your homeownership process.

Ginger Varga helps Veterans navigate the entire home-buying process with VA Assumable Home Loans. She has 15+ years of experience and works with buyers and lenders to find the ideal property within your given budget.

Reach out to Ginger, and she will help make the process of finding your dream home with the VA loan more seamless! Call: 214-789-7111

Texas Disabled Veteran Property Tax Exemption: Save Thousands (or Pay $0): FAQs

Q: Who qualifies for the Texas Disabled Veteran Property Tax Exemption?

In Texas, veterans with disabilities receive a property tax exemption based on their VA disability rating. A disability rating of 100% provides a complete exemption on the homestead.

For lower ratings, there are different exemptions:

• 10-29% disability gets up to a ($5,000) exemption

• 30-49% gets up to a ($7,500) exemption

• 50-69% gets up to a ($10,000) exemption

• 70-100% gets up to a ($12,000) exemption

Q: Does a 100% disabled veteran pay any property taxes in Texas?

In Texas, a 100% disabled veteran does not pay property taxes on their primary home. This complete exemption applies to their primary residence, and the surviving spouse can also obtain it if they are not remarried.

Q: Can surviving spouses claim the same benefit?

Yes, a surviving spouse is eligible for certain benefits, but they might not be identical to those of the deceased. The benefits a surviving spouse can receive depend on factors such as their age and Texas inheritance laws. A surviving spouse can also obtain Social Security survivor benefits.

Q: Do I need to reapply every year?

No, disabled veterans and their qualifying survivors in Texas do not have to reapply each year for the property tax exemption once it has been approved.

Q: What if my disability rating changes?

If your disability rating changes, your benefits and compensation in Texas could rise or fall. There will be a review of permanent and total disability, which may occur if there’s a rating adjustment.

To ask for an increase, you need to explain that your condition has deteriorated by providing updated medical records and treatment history. The VA may lower your rating if it thinks your condition has progressed. But they will send a notice of intended reduction and allow you an opportunity to reply.

Q: Can I claim both the homestead and disabled veteran exemptions?

Yes, it is possible to claim both the general homestead exemption and the disabled veteran’s exemption. This is because the veteran’s exemption qualifies as a homestead exemption.

A 100% disabled veteran receives a complete exemption from property taxes on their primary home. For different disability ratings, a partial exemption is applied to the homestead’s value.

Q: How long does it take to process the application?

In Texas, processing times for a Veteran Tax Exemption application vary, but applicants usually receive a response within several weeks. It is advised to submit applications by the regular deadline to ensure processing before tax bills are distributed.

Q: What if I move to a new home?

When relocating to a new residence in Texas, you need to submit a new application for a homestead exemption. It is essential to continue enjoying your property tax benefits, as the exemption applies only to your primary home. You can have only one main residence and thus only one homestead exemption at a time.

Q: Are there property tax exemptions for veterans renting their homes?

Generally, property tax exemptions are available to veterans who use the home as their primary residence. The specific rules are determined at the state and local level and can vary significantly.

Q: Where do I submit my Texas Disabled Veteran Property Tax Exemption form?

You must submit your Texas disabled veteran property tax exemption form to the appraisal district in the county where the property is located. The form can be submitted by mail or in person, and some counties also offer online submission.